Some major home improvements, which may classify as medical expenses or for a medical use, may be tax deductible. Such improvements include pools, spas, elevators, lifts, ramps, and other devices that can assist people living with a medical condition.

Helpful Home Improvements

According to the IRS, costs related to the diagnosis, cure, mitigation, treatment, or prevention of a medical condition or a disease count as medical expenses. And under this wide-range of categories, you can also deduct the cost of equipment, supplies, and any diagnostic devices you need. However, not just any purchase will do. These deductions extend to improvements made to help you or your spouse or other dependent living with you. And if these improvements increase the value of your home, that’s OK. Some of these costs can be deducted as well. How that works is you can deduct the cost of the equipment minus the increase in your property value brought on by the improvement. If there is no increase in property value, then you can deduct the entire cost associated with that improvement.

You can deduct costs associated with alleviating and/or preventing illness, be it physical or mental, and the home improvement must be primarily used for this reason. Sorry. Adding a walk-in spa and claiming it will help you relax or ease your stress at the end of a particularly difficult day isn’t going to get you much more than a possible audit.

Medical Deductions

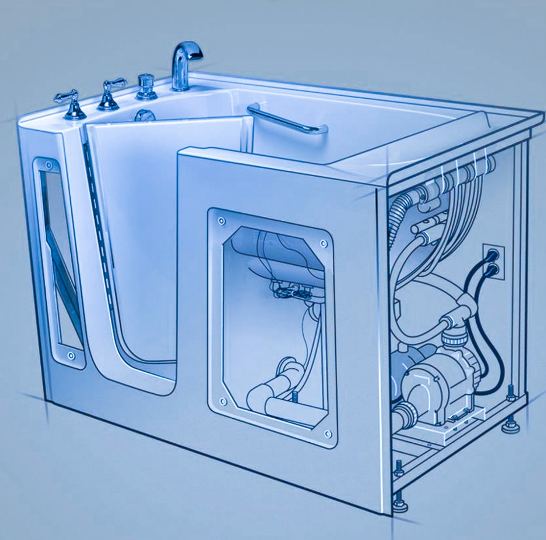

So how about that swimming pool, hot tub, or spa (swim or walk-in)? If water exercise is prescribed to you as part of an ongoing treatment plan, or as part of ongoing physical therapy, good news, you may be able to partly deduct the cost of the equipment on your tax return. Just be careful. The IRS is likely to question how much the pool or spa is being used for a medical-related condition, and how much the pool or spa is being used for recreation purposes. Show that the equipment is best suited to alleviate pain associated with your condition, and the IRS is likely to allow the deduction.

Other improvements that you may be able to deduct as medical expenses include the following:

- Entrance/exit ramps

- Widened doorways or entrances/exists

- Widened or otherwise altered hallways and doorways

- Railings, support bars, or other modifications to bathrooms (and since you’re more likely to slip and fall in a bathroom than in any other room in your home, you may want to start with these alterations, if you’re suffering from a medical condition that could cause you to lose your balance or if the bathroom is being used by an elderly adult)

- Lowered or otherwise modified cabinets and other equipment in the kitchen

- Modified electrical outlets, fixtures, fire alarms, smoke detectors, or other warning systems

- Lifts, but be careful, elevators are normally seen as adding value to your home

- Modified stairway

- Handrails or grab bars anywhere

Medical care costs should be limited to reasonable costs needed to accommodate a disabled condition or someone suffering from an ongoing condition. You can also include any costs associated with operating the improvement, such as air filters you need for a pool, spa, or heater. Hidden costs are also deductible, so water, electricity, cleaning, repairs, maintenance, and chemicals count.

The above information is provided for informational purposes only and should not be used as official tax information. Please review IRS Publication 502 or check with a certified public accountant. Publication 502 also has a list of medical expenses that you may or may not be able to deduct.